How to correctly price a Land Blind Offer Campaign

By S. Jack Butala

Before I show how to correctly price a land offer campaign here’s a few interesting points about this topic (why it’s so important):

- Pricing is easily one of the top three most frequently asked questions / topics about land investing.

- It’s not possible to consistently and successfully implement an offer campaign without accurate pricing.

- Great pricing can mean the difference between mailer yield (the percentage of properties you buy to the gross number of individual offers) of .01% to 1%. So for every 1,000 you buy one property vs ten. This is important financially because the profit on ten transactions vs. one is substantially different and you want to make sure you cover your mailer cost every time.

- For some this is an insurmountable task and it keeps many people out of this business.

- Direct mail offer campaigns rank among the highest as the most cost-efficient way market. Much more efficient than television, print or social media marketing.

- Finally, accurate pricing accomplishes two imperative ingredients to a mailer campaign; it keeps both you (the buyer) and the seller happy.

The math:

The average profit from a land transaction is about $10,000. Correctly priced, a mailer campaign can yield between .01% to 1% or 1 to 10 transactions per mailer. For every 1,000 mailer sent you can net between 10,000 and 100,000 in profit. The cost of sending 1,000 mailers is approximately $600.00.

How to price a rural vacant land mailer:

So you’ve have chosen county(s) or zip code(s) in which to send offers, downloaded the data, scrubbed out bad addresses and other unwanted data and you are ready for the last step before you send it to the printer; pricing. The spreadsheet is staring back at you, waiting for your action.

Like anything you do where you desire a positive outcome, you start with end and work your way back;

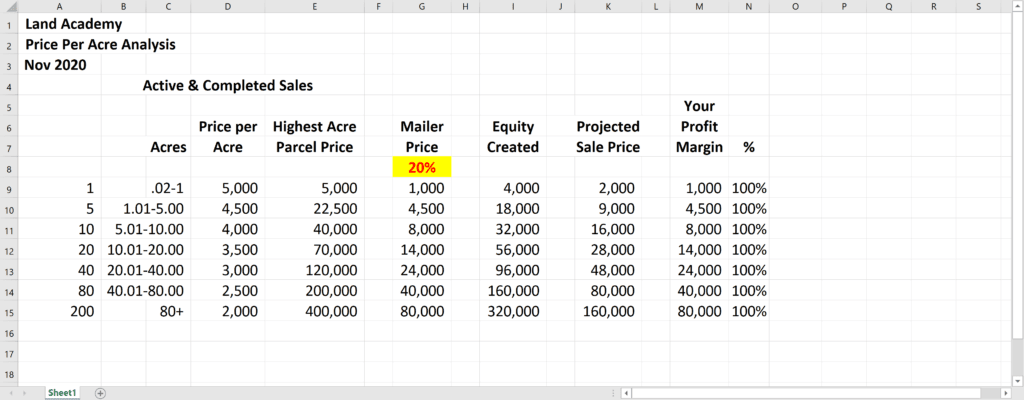

- Using Realtor.com, or Zillow.com or LandWatch.com or Land.com or a combination of all of them collect the following data: Sales price per acre (column D below).

- Break the Sales price per acre down into the following categories (prices are examples).

As you can see, price per acre always go down as sized go up the same way price per square foot in buildings usually go down the larger the structure (column D). Smaller is almost always more affordable and the more you buy the cheaper it gets is a complicated academic topic to be discussed in another arena. Let’s just say we all know it to be true.

Actual dollars per parcel go up making it less affordable the larger the property gets (column E).

Column F calculates the actual price of the offer. In this case, its 20% of the retail value of the property. This is where the real talent and experience shows. This percentage is the variable in all pricing senarios. In some cases 10% is appropriate and some cases 80% is. This number largely is determined by how much activity is happening in the area, how much data is available and how many parcels there are in the universe of property in that county. More on this another time.

Column I is the difference between the retail value of the property and your purchase price. This is the equity you have created for yourself in the transaction.

Column K is your projected sale price. I usually sell for twice what we paid unless the property is in extremely high or low demand.

There are many factors that can change how mailers get priced but I always start with this model and customize from here.

Good luck and please email me any questions or comments.